Article by Engineering.com. Read the full article here.

New companies are not selling their printers—they’re selling your parts.

Software as a service, or SaaS, asks users to rent time with software rather than buy it outright. While some users may detest this business model, it’s not too far removed from the way software worked in the 1960s, when users rented time with room-filling mainframes.

SaaS users avoid the need to purchase and maintain specific hardware while always having access to the latest technology. Variants of this same value prop— let someone else handle the details —underpin the growing shift to as-a-service models in other industries.

Industries like 3D printing, where more and more companies are opting to offer printing services rather than the printers themselves. Like SaaS, 3D Printing as a service—3DPaaS—has its pros and cons. But it may be a necessary step toward broader 3D printing adoption.

What Is 3D Printing as a Service?

3D printing has significant capabilities in manufacturing and design, with disruptive benefits in rapid prototyping, new geometries, small batch sizes and push-button manufacturing. But for some of the most important parameters, such as throughput, 3D printing doesn’t supplant or even match conventional manufacturing methods such as molding, machining or stamping.

In other words, industrial 3D printing has proven its value in niche applications, but it can’t broadly replace subtractive processes across the sector. At least not yet.

This niche applicability continues to make some manufacturers hesitant to invest in 3D printers for the shop floor. Couple that with the challenges of setting up and optimizing a 3D printer, especially with a workforce that remains overwhelmingly unfamiliar with the technology, and 3D printing may seem to be more trouble than it’s worth.

This is the current manufacturing landscape, and it may be driving 3D printing manufacturers toward 3DPaaS.

Seurat, a 3D printing company developing proprietary area printing technology, does not sell printers but instead operates a service bureau platform. Dedicated service bureaus such as Protolabs, Hubs and Xometry continue to grow, offering a range of on-demand manufacturing services, including a variety of 3D printing technologies. Other players in the 3DPaaS space include Norsk Titanium, Relativity Space, and Holo.

One of the latest to join the 3DPaaS wave is 3DEO, which offers a manufacturing service enabled by its high-volume metal additive solution. Engineering.com spoke with Matt Petros, CEO of 3DEO, to understand why the company has chosen this growing approach to the business.

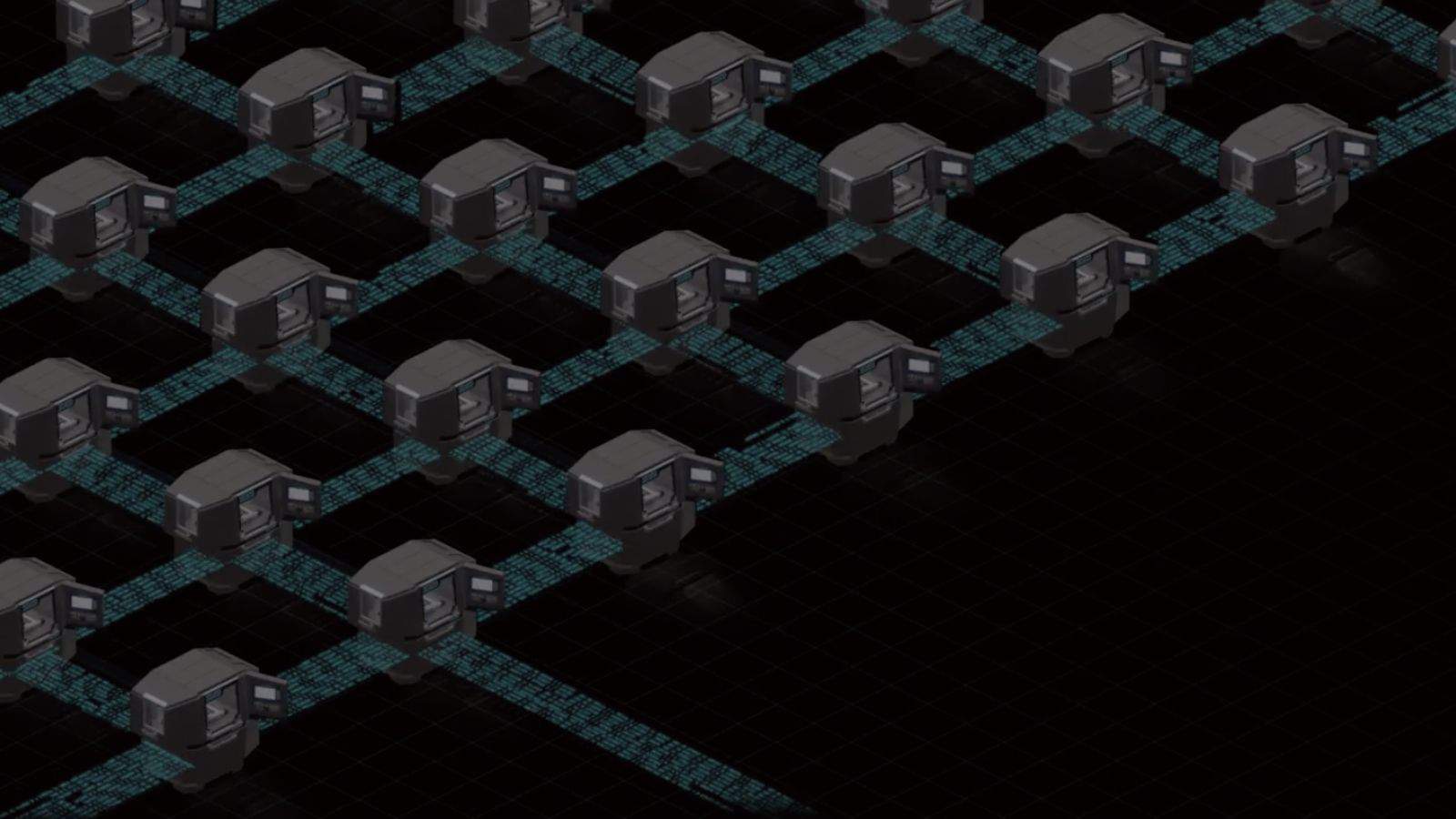

According to Petros, the most significant shift involved in the trend toward 3DPaaS is the global digitization of infrastructure in the manufacturing sector. When technology arises that can mitigate the major pain points of an existing model, that’s a disruptive technology. Just as advances in cloud computing enabled SaaS, technology developed by major service bureaus to enable quick turn, automated art-to-part systems for prototyping and ordering parts has lowered the barriers to entry for manufacturers. While implementation of a 3D printer on the shop floor takes months, Protolabs can put a part in your hands in a matter of days or weeks.

In addition, this shift to easy, flexible online ordering of parts is also democratizing access to tools and infrastructure in manufacturing, making it possible for smaller players to access expensive equipment.

Petros gave a parallel example of this in the SaaS industry. In the offices of many of today’s tech companies across the world, you’ll find a room, maybe in the basement, that’s a little colder than the rest of the office and a little better ventilated. This used to be the server room before many companies went to Amazon Web Services (AWS) for their server needs. When AWS gave companies the ability to easily access state-of-the-art, instantly scalable server technology, on-premises server rooms no longer made sense. Expenditures on infrastructure decreased, and companies spent that money elsewhere. Today, AWS is ubiquitous, and the on-premises server is a dying breed.

“In the same way, we’ve been seeing this happen in the world of manufacturing,” said Petros.

Access to manufacturing services enables smaller companies and startups to work in the same areas once reserved for deep-pocketed conglomerates. Access to technology democratizes innovation. This effect mirrors the democratizing effect that 3D printing technology itself has had on prototyping in plastics, for example.

In-House or 3DPaaS?

Will 3DPaaS turn out to be as disruptive as the as-a-service model was in the web hosting world?

Today, there are several factors that go into the in-house vs. outsourcing comparison in 3D printing. First, customers that choose to invest in their own equipment are also investing in the time and money needed to build infrastructure, printers and additional post-processing equipment, raw materials (including waste), amortization, labor, training, facilities and maintenance. According to Petros, these manufacturers may see their proficiencies affected, as operating increasingly sophisticated printing systems and software isn’t easy, and a lack of expertise can lead to missing important trends and skill-set gaps. Lastly, as engineering and design talent juggles learning new technology and systems along with their roles, innovation and launch timelines for new products may suffer.

To provide a counterpoint to 3DEO’s perspective, owning and operating machines yourself offers distinct benefits. First, investing in new equipment brings new capabilities to a business, potentially opening doors to take on new contracts or work in more industries. Second, despite the novelty of the technology, 3D printer OEMs and vendors typically provide training and support to enable your personnel to learn necessary new skills. Upskilling your teams adds value to your company. Finally, even as service bureaus get faster and become more competitive, it’s still likely that an in-house process can turn out parts with less lead time and do so more cost-effectively. 3D printer owners also don’t have to share their IP, such as part drawings, with a third-party players—something that is nonnegotiable in some cases. Owners also have full control over the settings, materials and parameters of the machines, for better or worse.

In the short term, however, when parts are needed immediately, a service bureau such as 3DEO will certainly outcompete an entire 3D printing implementation on time and cost. According to Petros, valuable new skills are gained through the partnership with 3DEO experts in the process of ordering parts. A simple analogy might be dinner: sure, cooking at home is cheaper and more flexible, but first you need to learn how to cook.

“Simply put,” said Petros, “outsourcing de-risks the manufacturing process to avoid a large capital outlay.”

What’s Next?

From a technology standpoint, the 3DPaaS model sees 3D printer OEMs shift from equipment vendors to vertically integrated end-to-end manufacturing platforms. At 3DEO, the Saffron software platform enables the entire service, so innovation on the software side is as important as hardware development. For other players such as Seurat, the greater control over its technology may provide benefits for better protection over the company’s new technology, more resources for development as the company doesn’t need to focus on machine sales, and better results for customers, as the work is done by experts.

While disruptive tech such as 3D printing or 3DPaaS may force existing OEMs to adapt, by its very definition, such technology rewards consumers with better value and a better experience. For the 3D printing industry and the manufacturing sector, that’s good news.